Conflict of Interest

Management Policy

For Bidvest Insurance Limited and Bidvest Insurance Brokers (Pty) Ltd

1. Definitions

“Associate” means in relation to:

- a juristic person, which is a company, any subsidiary or holding company of that company, any other subsidiary of that holding company and any other company of which that holding company is a subsidiary; a company which has a common director with the Companies or BIG as its holding company.

- In relation to a juristic person that isn’t a company, means any person in accordance with whose directions or instructions the members of, or the governing body of the juristic person is accustomed to act on, had both the first-mentioned juristic person been a company.

- a natural person, means a person who is:

- recognised in law or the tenets of religion as the spouse, life partner or civil union partner of that person;

- a child of that person, including adopted child and a child out of wedlock;

- a parent or stepparent of that person;

- a person in respect of which that person is recognised in law or appointed by a Court as the person legally responsible for managing the affairs of or meeting the daily care needs of the first mentioned person; or

- a person who is in a commercial partnership with that person;

- any person, means any juristic person of which the board of directors or members or the governing body is accustomed to act in accordance with the directions or instructions of the first-mentioned juristic person, and includes any trust controlled or administered by that person;

“Bidvest Insurance Ltd” or “BIL” means Bidvest Insurance Limited, Registration number 1997/019461/06, an Authorised Financial Services Provider, FSP No 46395;

“Bidvest Insurance Brokers (Pty) Limited” or “BIB” means Bidvest Insurance Brokers (Pty) Limited, Registration number 1967/000378/07, FSP No 44446;

“BIG” means Bidvest Insurance Group (Pty) Limited, Registration number 2011/010418/07;

“Board” means the Board of directors of the Companies;

“Companies” mean BIL and/or BIB, which are located at 2nd Floor, Lincoln on the Lake, 2 The High Street, Umhlanga Ridge 4319, South Africa;

“Conflict of interest” means any situation in which a Financial Services Provider or Representative, has an actual or potential interest that may, in rendering a financial service to a customer:

- influence the objective performance of his, her or its obligations to that customer; or

- prevent a Financial Services Provider or Representative from rendering an unbiased and fair financial service to that customer, or from acting in the interest of that customer, including but not limited to: –

- a Financial interest;

- an Ownership interest; or

- any relationship with a Third Party.

A Conflict of interest shall include any Ownership interest in a Supplier and any Financial interest paid to, or received from a Supplier;

“Customer” means any person who is a policyholder of or potentially could become a policyholder;

“Distribution channel” means:

- any arrangement between a product supplier or any of its associates and one or more providers or any of its associates in terms of which arrangement any support or service is provided to the provider or providers in rendering a financial service to a customer;

- any arrangement between two or more providers or any of their associates, which arrangement facilitates, supports or enhances a relationship between the provider or providers and a product supplier; or

- any arrangement between two or more product suppliers;

“Employee” or “Employees” means any person who is employed by the Companies, including contractors and any temporary employees;

“Exco member” means a member of the Executive Committee of the Companies;

“Family” means any person to whom an Employee is related through birth or marriage;

“Financial Director” means the executive director who is responsible to fulfil the role of Chief Financial Officer of the Companies;

“Financial interest” means any cash, cash equivalent, voucher, gift, service, advantage, benefit, discount, domestic or foreign travel, hospitality, accommodation, sponsorship, incentive, or valuable consideration, other than training, that is not exclusively available to a selected group of financial services providers or representatives, on:

- products and legal matters relating to those products;

- general financial and industry information; or

- specialised technological systems of a Third Party necessary for the rendering of a financial service; but excluding travel and accommodation associated with that training;

“Fair Value” has the meaning assigned to it in the financial reporting standards adopted or issued under the Companies Act, 1973 (Act No. 61 of 1973);

“FAIS Act” means the Financial Advisory and Intermediary Services Act, No 37 of 2002, as amended;

“Financial Services Provider” means any person, other than a representative, who as a regular feature of the business of such person:

- furnishes advice; or

- furnishes advice and renders any intermediary service; or

- renders an intermediary service;

“FSCA” means the Financial Sector Conduct Authority, a regulatory body established in terms of the Financial Sector Regulation Act, Act 9 of 2017, or its predecessor, the Financial Services Board, established in terms of the Financial Services Board Act, Act 97 of 1990;

“Head of Control Function” means the person appointed in terms of the Insurance Act, No 18 of 2017 as the Head of a Control Function of the Companies;

“Holding Company” means a Bidvest Insurance Group (Pty) Limited, a non-operating holding company which is, in turn wholly owned by The Bidvest Group Limited.

“Immaterial financial interest” means any financial interest with a determinable monetary value, the aggregate of which does not exceed R1000 in any calendar year from the same Third Party in that calendar year received by:

- a Financial Services Provider, who is a sole proprietor;

- a Representative for that Representative’s direct benefit; or

- a Financial Services Provider, who for its benefit or that of some, or all its Representatives, aggregates the immaterial financial interest paid to its Representatives;

“Key Individual” means a key individual as defined in the FAIS Act;

“Managing Director” means the executive director who is responsible to fulfil the role of Chief Executive Officer of the Companies;

“Ownership interest” means:

- any equity or ownership interest, for which fair value was paid by the owner, other than equity; and includes any dividend, profit share or similar benefit derived from that equity or ownership interest; and

- any ownership interest in a Supplier held by an Employee or Representative or his or her Family;

“PoPIA” means the Protection of Personal Information Act, No 4 of 2013;

“Representative” means any person who is appointed as a Representative in terms of the FAIS Act;

“Responsible Persons” means Directors (including Non-Executive Directors), EXCO member, Heads of Control Functions and a significant owner of shares or financial interest in the Companies;

“Short-term Insurance Act” or “STIA” means the Short-term Insurance Act, No 53 of 1998, as amended;

“Subsidiary” means a subsidiary as defined in section 1(3) of the Companies Act, 1973 (Act No. 61 of 1973);

“Supplier” means any person, whether a natural or a legal person, who is contracted to the Companies to supply goods or services to the Companies and shall include Binder or Outsource agreements entered into with such persons in terms of the STIA; and

“Third Party” means either:

- a product supplier;

- another Financial Services Provider;

- an associate of a product supplier or a Financial Services Provider;

- a Family member;

- a Customer;

- a Supplier;

- a distribution channel; or

any person, in terms of an agreement or arrangement, who provides a Financial interest to a Financial Services Provider or its Representatives.

2. The Regulatory basis for this policy

Board Notice 58 of 2010, as issued by the FSCA in terms of the FAIS Act, sets out various provisions for management of Conflict of interest. These provisions apply to all authorized Financial Services Providers as they are required to adopt a Conflict of interest Management Policy which caters for measures to identify, avoid and/or mitigate actual and potential Conflicts of interest.

It is the responsibility of all Responsible Persons, Employees and Representatives of the Companies to comply with this policy proactively, and in good faith, declare an actual or potential Conflict of interest, and to seek advice in cases of uncertainty.

3. Identification of Conflict of interest

3.1 Employees and Representatives

Employees and Representatives must avoid Conflicts of interest where they have an interest in or stand to benefit from any transaction to which the Companies are also a party. This applies whether the Employee or Representatives has an interest or stands to benefit:

- Individually;

- In association with their family members;

- In association with business partners; or

- In relation to external or internal business interests.

A Conflict of interest Questionnaire is to be signed by all Employees and Representatives confirming the presence or absence of any actual or potential Conflict of interest on an annual basis. All Employees and Representatives must disclose in writing to their Key Individual or an Exco member or to the Human Resource Department of the Companies on an ongoing basis, any Conflicts of interest of which they may become aware.

All gifts received by Employees and Representatives are subject to the Gift policy as detailed in Section 5.4 below.

All Employees and Representatives are required to actively seek to identify, mitigate and document Conflicts of interest in their business unit, including any Conflicts of interest in connection with any current or planned activities.

All instances of non-compliance must be reported in line with the process set out in the Protected Disclosure policy of the Companies as adopted in terms of PoPIA.

3.2 Key Individuals and Exco members

In terms of the FAIS Act, the Key Individuals are responsible for the oversight and management of the business activities within the Companies for which they are appointed as Key Individuals, or certain aspects thereof. This responsibility includes the implementation and continued compliance with the Conflict of interest requirements of the FAIS Act and its subordinate legislation, as well as this policy.

The Key Individuals and Exco members are required to assess any Conflicts of interest reported or disclosed to them to determine if a Conflict of interest exists and to consult the Compliance Function of the Companies, where necessary, in determining the best course of action to resolve, manage or avoid the Conflict of interest, including further escalation to a higher management authority where necessary.

The Key Individuals and Exco members are responsible to ensure that all required declarations have been executed.

3.3 Compliance and Legal

The Head of Compliance and Legal will provide guidance in respect of the interpretation and implementation of this policy. The Head of Compliance and Legal will provide regular confirmation on the implementation of and adherence to this policy.

The Compliance and Legal Department is responsible for conducting an annual review of all contracts with Suppliers and for providing assurance of adherence to the Conflict of interest requirements of the Outsource policy in respect of Suppliers.

The Head of Compliance and Legal will provide confirmation of the Companies’ associates, confirmation of the list of names of all third parties in which the Companies have an interest, and confirmation of the list of names of all third parties that hold an ownership interest in the Companies.

The Head of Compliance and Legal will monitor the implementation of the Gift policy as detailed in section 5.4 below and where appropriate will be reported in the Compliance report to Risk Committee.

3.4 Human Resource (HR) Department of the Companies

All signed Declaration forms completed by Employees and Representatives shall be retained on file by the HR Department.

The HR Department shall retain on file the Code of Ethics of the Companies as signed by each Employee and Representative.

Training in respect of this policy will be provided by the HR Department to all new Employees and Representatives and at least annually to all other Employees and Representatives.

3.5 Marketing Manager of the Companies

All gifts received from or provided to a third party with an estimated value of R200 or more, are subject to the Gifts policy as detailed in section 5.4 below and are to be recorded by the Marketing Manager in the Companies’ gift register.

3.6 Directors

Subject to legal provisions, each director shall submit to the Board an annual declaration of all financial, economic and other interests held by the director in respect of an Associate or whenever there are significant changes.

At the beginning of each meeting of the Board, all directors are required to declare whether any of them has any Conflict of interest in respect of a matter on the agenda for that meeting. Any such conflicts should be proactively managed as determined by the Board and subject to legal provisions.

The Board should agree on whether the Managing Director takes up additional professional positions, including membership of other governing bodies outside the organisation. Time constraints and potential Conflicts of interest should be considered and balanced against the opportunity for professional development.

4. Identification of Conflict of Interest

For the purpose of this section, the following activities are not regarded as a Conflict of interest:

- Advertising, brand awareness to targeted or select customer groups or distribution channels;

- A binder agreement entered in terms of the STIA; and

- Employment Equity initiatives (in respect of employees) and Enterprise Development initiatives (in respect of business relationships) undertaken as part of transformation.

The Companies employ the following mechanisms to ensure that all conflicts are identified:

4.1 Before a new business arrangement is concluded, consideration is given to whether the proposed arrangement will present any potential Conflict of interest and the requirements of the Companies’ Outsource policy in respect of Conflict of interest will apply.

4.2 The Managing Director and Financial Director sign off all agreements which have been pre-vetted or prepared by the Legal Department. Monitoring for performance on an ongoing basis is performed by the Legal Department in conjunction with the Heads of Department to which such contract pertains to ensure that these contracts and relationships influence the Companies: –

- objective performance towards its customers;

- ability to render fair and unbiased financial services toward its customers; and

- ability to act in the best interest of the customer.

- All Employees and Representatives are responsible for identifying instances of Conflict of Interest and are required to notify their Business Unit Manager and/or the Financial Director of any conflicts of which they become aware.

5. Avoidance and mitigation of Conflict of interest

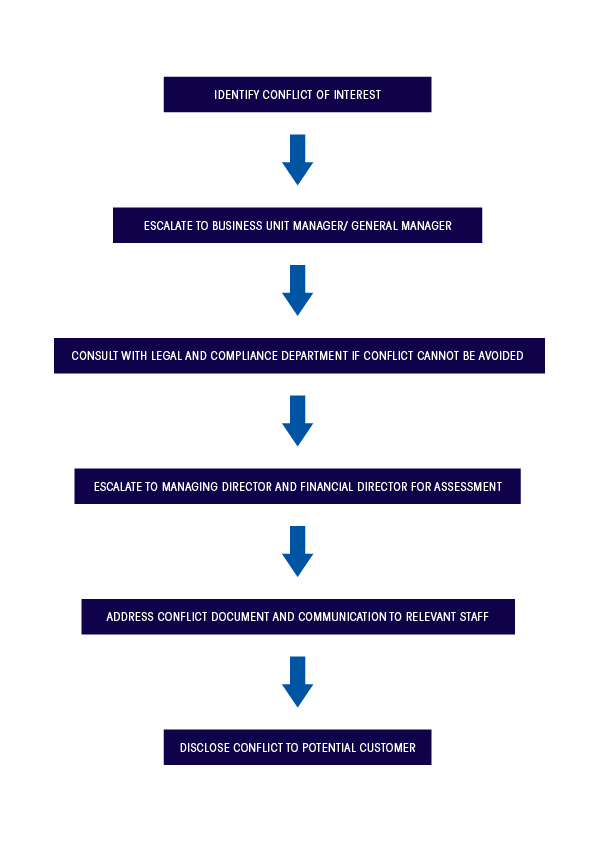

Once a Conflict of Interest has been identified it should be appropriately and adequately managed. The head or manager of the affected department will consider whether any practical means exists for avoiding such Conflict of Interest. Where this is not practical, the head or manager of the affected department will consult with the Managing Director and Financial Director to devise appropriate and adequate measures to mitigate and manage the identified Conflict of interest.

The resulting mitigating and managing measures will be documented and communicated to all Employees and Representatives involved in managing the relationship to ensure that the risk of the identified Conflict of interest is appropriately managed and does not recur.

Refer to the diagrammatic representation in Annexure A.

The Companies has various internal policies to manage and mitigate Conflicts of interest. These internal policies govern the ethical conduct of Responsible Persons, Employees and Representatives in the following manner:

5.1 Code of Ethics: Ethical conduct for Responsible Persons, Representatives and Employees:

- The Code of Ethics is to be accepted and signed by all Responsible Persons, Employees and Representatives of the Companies upon engagement;

- Employees, Representatives and Responsible Persons must maintain integrity in their dealings with customers and suppliers;

- Employees, Representatives and Responsible Persons must avoid any activities that may lead to an actual or perceived Conflict of interest within the business of the Companies;

- In accepting business or entering contracts, Responsible Persons must observe the highest standards of integrity and act in the best interests of the company and the customer;

- Employees, Representatives and Responsible Persons may neither support nor solicit loans, gifts in cash or in kind, free-of-charge services or any other favours from any current or prospective business partner;

- Employees, Representatives and Responsible Persons must not deliberately give inadequate or misleading descriptions of products and services; and

- Employees, Representatives and Responsible Persons must maintain the confidentiality of information received from insurers, customers, suppliers and intermediaries.

5.2 Remuneration policy

The Remuneration policy as adopted by the Board makes provision for the management of Conflicts of interest which may arise from the remuneration practices of the Companies and in particular the incentives which are paid to Employees and Representatives. The implementation of the Remuneration policy is overseen by the Remuneration Committee of the Companies.

5.3 Governance independence

In order to provide independent assurance to the governance structures of the Companies, a Head of a Control Function shall not have any operational duties or responsibilities and will perform his or her duties in a manner which is independent from the operations of the Companies.

5.4 Gift policy

The provision or acceptance of gifts and corporate hospitality by an Employee or Representative is acceptable provided that any such gift or hospitality received does not exceed the maximum value of R1 000 per year from any one insurer, as stipulated in Board Notice 58 of 2010.

As required by the Code of Ethics of the Companies, individual gifts with a monetary value in excess of R200 are to be recorded in the Gift Registers as detailed below:

- All gifts received by a Representative are to be recorded in a separate Gifts Register for Representatives which is maintained by the Compliance Department; and

- All gifts received by Employees who are not appointed as Representatives are to be recorded in the Gifts Register for Employees which is maintained by the Personal Assistant to the Managing Director.

5.5 Levels of Authority

- A Levels of Authority document shall be in place and adopted by the Board to provide for the appropriate level of sign-off for all payments to Suppliers as well as for the sign-off of all contractual arrangements; and

- A Levels of Authority structure shall be in place and signed off by the Managing Director to provide for the appropriate level of sign-off of all claim settlements.

5.6 Outsource policy

Conflicts of interest in respect of Suppliers shall be managed in terms of the Outsource policy where a declaration confirming the presence or absence of any actual or potential Conflict of interest will be signed by the Supplier.

5.7 Policies adopted in terms of PoPIA

the Companies have adopted policies in line with the requirements of PoPIA, which policies provide for the appropriate management of data of both natural and juristic persons in a manner which addresses potential Conflicts of Interest.

5.8 Sign-on bonuses

The Companies do not offer any sign-on bonuses to any new Employee or and Representative or to any service provider (including Financial Service Providers).

6. Disclosure of Conflict of interest

The Companies or an Employee or a Representative will, in writing, at the earliest reasonable opportunity disclose to a customer any potential Conflict of Interest in respect of that customer. The disclosure must include:

- The existence of the Conflict of interest;

- A description of what the conflict is;

- Its impact;

- The measures taken to mitigate and manage it; and

- The customer’s free choice whether he/she wishes to continue with procuring the product.

The onus is on Responsible Persons, Employees and Representatives who are subject to this policy to ensure that proper disclosure is made in respect of a Conflict of interest, despite this being contained in the product fulfilment documentation. To assist in this regard, a Conflict of interest Questionnaire shall be completed by all Employees and Representatives.

7. Processes, procedures and internal controls to facilitate compliance

The Executive Management in conjunction with the appointed Key Individuals of the Companies must ensure that the policy is implemented.

Training for all affected Employees and Representatives will be provided by the Compliance Department or the Training Manager of the Companies to ensure that they understand their responsibilities under this policy.

The Companies Management and the Compliance Department will monitor compliance with this policy and will perform the necessary reviews in consultation with Executive Management to ensure that effective and appropriate procedures and processes are in place in order to comply with this policy.

8. Financial interest offered to Representatives

The Companies may offer sales incentives to its Representatives, in addition to their basic salary, based upon a combination of:

- The quantity of the business introduced and the achieving of set targets; and

- The quality of the services rendered to customers (as measured by the the Companies’ Quality Assurance process).

9. Financial interest offered to Third parties

The Companies may only offer the following financial interests to Third parties:

- Commission authorised under the STIA; and

- Fees that are reasonably commensurate with the service being rendered and authorised under the STIA.

The Companies may only offer the following financial interests to Third parties:

- Fees for rendering a financial service in respect of which no commission or fees are paid, if those fees are specifically agreed to in writing by the customer and may be discontinued at the discretion of the customer;

- Fees or remuneration for the rendering of a service by a Third Party, which fees or remuneration are reasonably commensurate to the service being rendered;

- Any immaterial financial interest as defined in the General Code of Conduct as issued under the FAIS Act; and

- Any other financial interest, for which consideration that is reasonably commensurate with the value of the financial interest, is paid by the Companies or a Representative at the time of receipt thereof.

10. Recruitment

the Companies do not approve of nepotism and understands that all applicants have the right to apply for vacant positions. Therefore, where family members, friends or business associates of an Employee or Representative apply for a vacant position, the principles as contained in Section 3 of the Code of Ethics of the Companies must be followed.

11. Moonlighting

Moonlighting refers to a situation where someone holds a second job while in the service of their employer. All Employees and Representatives who engage in moonlighting activities must ensure that they do not get involved in any activity that could lead to a potential Conflict of interest.

To avoid potential Conflicts of interest, Employees and Representatives must follow the procedures outlined in the Code of Ethics of the Companies.

12. Procurement

The Employees and Representatives responsible for the procurement of goods and services on behalf of the Companies may not directly or indirectly accept any reward from any person. This applies whether the reward is for themselves or for any other person. The Employees and Representatives responsible for procurement may also not provide, offer or make available any gift or invitation to an event that will, or can be perceived to:

- Influence the recipient’s judgement on a specific matter;

- Cause the recipient to favour one customer, supplier or trading partner over another;

- Expect the recipient to take certain actions or expect the recipient not to take any action; or

- Influence the recipient to conduct himself or herself in a certain manner.

When on-boarding suppliers through procurement procedures, all Employees and Representatives responsible for procurement must avoid any Conflicts of interest between the Companies, the interest of its stakeholders and the business of the person performing the outsourced activity. If this is not possible, the Employee or Representative responsible for procurement must mitigate these Conflicts of interest.

It is the responsibility of the Human Resource Department of the Companies to collect and retain on file the annual Conflict of interest declarations from Employees and Representatives confirming that no reward was or will be collected from any person as discussed above.

Disciplinary steps will be taken against any person who accepts any reward that is subject to the above, whether for himself or herself, or on behalf of any other person.

If any person knows about or suspects a contravention of this section, he or she must report it to the Managing Director or Financial Director.

13. List of Associates of the Companies

A list of Associates is available on request at the registered office of the Companies.

14. Third parties in which the Companies holds an ownership interest

The Companies does not hold any ownership interest in third parties.

15. Third parties who hold an ownership interest in the Companies

The Companies does not hold any ownership interest in third parties.

16. Consequences of non-compliance with the Conflict of interest Management policy

This Conflict of interest Management policy is provided to all Employees and Representatives. All Employees and Representatives are required to read this policy and sign a statement confirming that they have read and fully understood the provisions of the policy and the application thereof.

Failure to comply with the provisions of this policy by any Employee or Representative shall constitute serious misconduct and will result in disciplinary action being initiated against them. Avoidance, limitation or circumvention of this policy will be deemed serious non-compliance.

17. Policy Review

The policy is subject to regular review and approval by the Boards of the Companies. Any proposed interim changes must be approved by the Executive committee of the Companies after recommendation by the Compliance Department.

Annexure A